If you are following this thread from the previous posting, it explained the history of the real estate industry from 1800’s to 1960’s. Remarkably, the 1970’s saw the peak and trough of the real estate industry. Smart real estate buyers would buy properties at the trough and sell at the peak of the real estate circle. Remarkably, these cyclical circles are revisited every seven years from the black Friday of 1929 to date, all due to political, environmental, social, technological, economic and legal considerations (PESTEL). In-house financing through financial institutions became the new creative or re-engineered method of advancing loans to potential buyers or mortgagees. Local lenders skewed the already gleaned information within the central computer systems (big data) to meet short term gains to the detriment of the entire financial system (Aluya and Garraway, 2014). Redlining gradually disappeared supposedly (supposedly because it reappeared again in 2016) and the financial institutions, nevertheless embraced greenlining in 1970’s

The historicity of real estate period of the 1970s and 1980s

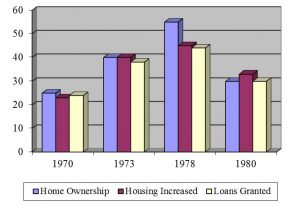

In the 1970’s, financial institutions introduced “greenlining, instead of redlining” (Dreier, 1991, p.24). For instance, the United States Congress supported President Carter’s administration in promulgating two pieces of legislature, (a) the Home Mortgage Disclosure Act (HMDA) 1975, and (b) the Community Reinvestment Act (CRA) of 1977¾thrifts, commercial banks and credit unions were mandated to disclose loans granted for home improvements or for home-buyers. Unsurprisingly, the promulgation of these acts overtly removed the institutionalized methodology of not granting loans to minorities. Adduced, the loan granting processes to individuals became more transparent during this time. Totting the loans granted was recorded; the data extrapolated confirmed and confuted the straight jacket actions of the mortgage companies. Understandably, there was an affirmative incentive or responsibility for financial institutions to be unjaundiced in their lending practices (Aluya, 2010a). Quid pro quo, incentive and intense competition anchored on profited loans granted to home owners whose standards of living were positively affected became the norm. Technological Situational Happenstances (TSHs and PESTEL) were also used to collate, expose and track financial institutions that violated these actions¾of course; financial consequences were prescribed to the violators (see figure 1 below).

Figure 1: Epoch of the 1970s to 1980s

Source: Aluya 2017 at the aluyainstitute.com

Epoch of the 1980’s

In the 1980’s, redlining completely disappeared in the parlance of financial institutions’ lexicon but unfortunately reappeared in 2014 (Larson, 2014). Take the city of Boston, for instance, where middle-income people fled due to disparities in financial institutional lending idiosyncrasies toward minorities, actions of the institutional lenders led to political consequences. For example, the financial institutions’ continuous idiosyncratic or obstinacy of redlining forced Mayor Kevin White to step down from office in 1983 (Dreier, 1991). Prosperity returned to Boston after electing a populist city councilor, Ray Flynn. In the 1980’s, the most remarkable or historic event was the emergence of private funding for housing. Redlining returned when the New York Attorney General, Eric Schneiderman filed a suit against Evans Bancorp for discrimination. The people of African-American community that lives in Buffalo areas of New York were completely discriminated against when applying for loans or the bank subliminally refused to grant the minorities loans. Statistically, out of 1,114 loans granted in the Buffalo areas only four loans were granted to minorities of African descent (Larson, 2014). And this was the clear definition or meaning of redlining. Whereas revised redlining could be described as the Evans Bancorp intentionally granting usury loans or higher interest rates to the same minorities.

Retrospectively, the demand for home funding exceeded the supply during the 1980s (Pindyck and Rubinfeld, 1989). People started seeking private lenders to fund their homes due to the high demand of applicants seeking home financing. Amongst the private lenders who emerged, reengineered, and reinvented themselves with TSHs were the Savings and Loans institutions. Historically, the Savings and Loans (S&Ls) originated out of the necessity and need to fund private homes. Traditional financial institutions were unable to meet the insatiable demand for private funding of homes during this period. Synthesizing the historical root of S&Ls, in 1835, the Terminating Building Societies (TBS) was reengineered and transformed into the Permanent Building Societies, later to Building Loans; then transformed again to become the Savings and Loans for funding private investors during this time (Cho, 2007). The transformation of TBS into Savings and Loans led to the emergence of Charles Keating as one of the financial executive of the institution. Charles Keating became synonymous with S&Ls. Charles Keating’s actions of using TSHs disadvantageously through the internalization processes of funding private loans led to the rapid rise and debacle of S&Ls. Charles Keating’s internal method of funding, granting loans to private individuals or entities fundamentally changed how the financial loan institutions conducted housing loan transactions with TSHs and PESTEL in the United States (Aluya, 2009). Inevitably, some of the picayune decisions made by Keating vacuously led the flaring up, yet flaming out of the S&L and other institutions. Keating with his paeans bungled up granted loans, bubbled it up, eventually busted up the method of granting loans to individuals and hodgepodge of businesses.

Interestingly, Charles Keating, some scholarship critics counter-posed was a savvy or a delphic businessman with an unfathomable business acumen (Cho, 2007; Lea 1994). Keating filled the void of lending to private investors or homeowners. Unsaid, Keating took advantage of the loopholes with mirage of changes created by the United States Congress for self-promotion or for self-aggrandizement. This was an overreaching and overflowing of lavishness of greed opprobrium that unfortunately undid him.

Retrospectively, the United States Congress in the 1970s passed these series of changes, deregulations or loopholes for the liberalization of loans. What Charles Keating did was not different from any other executive leader of a giant corporation would do. These corporate executive leaders’ unethical or unscrupulous actions led to the contributions of major sums of money to the Democratic and Republican parties to pass laws that transcended toward favoritism in Washington, DC. When S&Ls failed in the late 1980s, the contagion and consequences was at least a $300 billion bailout by the United States taxpayers (Aluya, 2009; Dreier, 1991; Lea 1994). Allen Greenspan who was a financial consultant to Charles Keating carried out an audit analyses and gave the S&L a clean bill of health, then later acquiesced to the bail out of S&L (Greenspan, 2008). Although financial institutions built tactical, strategic firewalls to safeguard and avoid similar S&L pitfalls, apparently, lessons learned from the S&L debacle were simply brushed aside.

Financial institutions quiescently continued to brush aside or ignored the fundamental tenets of granting loans to applicants; to be proximate; it was lenders malfeasance or malaise. Most significantly, the fundamental tenets deeply rooted and inculcated in the five¾C’s were ignored. Relevantly, the 5C’s were: collateral, capital, condition, capacity and credit that the financial institutions ignored while granting loans (Aluya, 2007, 2007a, 2008; Karley, 2003). Karley postulated that once these financial benchmarks used as litmus tests for granting loans to applicants were not followed, financial institutions were clinically or technically revisiting the crisis of the S&L debacle (see figure 5 below). With TSHs and PESTEL, the re-engineering of funding loans continued with Greenspan¾the United States Federal Reserve Chairman who liberalized the mortgage industry. There were contrasting scholarship points made regarding these arguments with respect to Greenspan’s financial re-engineering methodology explained in the epoch of the 1990’s and late 2000’s. Get an electronic version of this book for continuous reading and for all the references used herein at http://www.jofdt.com/product/leadership-real-estate-and-disruptive-technology-technological-situational-happenstances-2nd-edition/