Following this thread from the previous posting, it explicitly explained the historicity of the real estate industry from 1800’s to 1980’s. Remarkably, in the 1970’s to 1980’s, in the real estate industry, we witnessed the consistent and constant gyration of the 7 years to 10 years’ peaks and troughs. Apparently, real estate buyers would buy at the troughs and sell at the peaks of the real estate circle. Other real estate investors will invest in Real Estate Investment Trusts (REIT), while other investors will buy properties at auctions, fix it up and flip for profit. Remarkably, these cyclical circles are revisited every seven years to ten years from the black Friday of 1929 to date, all due to political, environmental, social, technological, economic and legal considerations (PESTEL). In the 1990’s, however greed became the providential child of the real estate agents and toxic paper also became the vogue for the financial institutions. In-house financing through financial institutions resulted in the new creative or re-engineered method of advancing loans to potential buyers or mortgagees. Local lenders skewed the already gleaned information within the central computer systems (big data) to meet short term gains to the detriment of the entire financial system (Aluya and Garraway, 2014).

Begins the epoch of the 1990’s and to the late 2000’s

Most significantly, Greenspan, the 13th chairman of the United States Federal Reserve, created an avenue for mortgage lenders to maximize profit by lowering interest rates on loans for sequined homeowners. Lowering the interest rates contagiously stimulated the United States economy. Stimulation of the United States halcyon economy cascaded into mortgage industries instantaneously using TSHs and PESTEL in approving the subprime or second chance loans to applicants. The effect of Greenspan’s continuous stimulation of the economy using the United States Federal regulatory system resulted in the robustness and appreciation of the housing market (Greenspan, 2008; Greenspan and Kennedy, 2005).

Without any doubt, the actions of the Federal Reserve Chairman with all his affirmative intentions hymnally stimulated the United States economy. California real estate in particular or the housing market in general within the United States appreciated. For instance, the appraisal of homes in California and the value of homes almost doubled from 2003 to 2006 (Aluya, 2007). This was an irrational exuberance that even the sophisticated financial Wall Street expert’s code named this phenomenon the “Greater Fool Theory.”(Aluya, 2014, p.121). Mortgage brokers used TSHs and PESTEL to approve over $3 trillion US dollars’ worth of loans instantaneously and expeditiously for homeowners during this period with or without the capacity of the buyers to repay the amortized loans.

More frequently, the approved loans for home-buyers were vagarily detrimental to the mortgagees’ and mortgage industries. In the process, the intermediation of credit lines or mortgage credit lines became contaminated. Mortgage bankers introduced various financial re-engineering formulas in frenzy for granting loans to applicants. In California, for example, two to three year’s adjustable interest loans were extended to 40 years (then to 50 years) amortization of loans were introduced. Homeowners were enamored by owning these loans irrespective of the financial consequences. Mortgage bankers or homeowners came under the assumption that the housing market would continue to appreciate because of the Greater Fool Theory. Wrong!

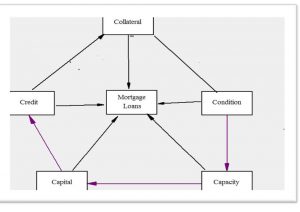

As a result of the sophisticated actions of these financial experts, the homeowners were unable to pay the premiums associated with the loans granted. Homeowner’s short-term obligations to repay loans granted were literally not met. These mortgage installments created through some cloaked process became toxic papers in the lexicon of the financial industry. Encrypted mortgage papers were worthless, values of homes were overly inflated and equity in the homes evaporated. An initial formula used by these financial experts that reengineered the new lending practices were calculated on the basis of three percent down with ninety seven (3/97) financing for home purchased went south. Meaning things went from bad to worse for the homeowners and the financial institutions. The United Federal Reserve Chairman actions unfortunately resulted in a recession in California then contagiously overflowed into the United States main street economy and subsequently to the global economy. California’s giant economy was the eighth largest in the world. At this time, the exotic financial reengineering loans to home buyers resulted in the creation of Collateralization of Debt Obligation (CBO), Structured Investment Vehicle (SIV), Asset-Based Commercial Papers (ABCP), and Special Pilot of Entities (SPE). All in all, these innovated financial novelties were bundled up, bungled up and busted up. Compounding the recession was the chicanery actions of the mortgage bankers like Washington Mutual Bank, CountryWide Mortgage, Wachovia, Citigroup, Wells Fargo Bank, and Bank of America. Noted, that the aforementioned institutions have either re-consolidated with other banks or simply have closed shops. As cantankerously provocative as it might seem, these financial institutions ignored the five C’s which were the fundamental tenets of granting loans (see figure 1 below). In vein of the recovery period, the same institutions were refusing to follow the same five C’s in granting loans. Concomitantly, the aforementioned financial institutions were now hoarding excessive cash balances instead of using the five C’s criteria in lending to individuals, private investors to expand and jump-start economic recovery process in the United States. A harbinger for possible deep recession for the United States economy, now obviously averted due to the Obama’s bail out.

Figure 1: General assessment test

Source: Aluya 2017 at the aluyainstitute.com

Second, Greenspan’s didactical liberalization of the financial mortgage institutional practices continued until his retirement. Avenues for loans originators chicanery with brazen efforts to forge loan documentation became ubiquitous. Lampooned financial risks became the satiric songs. Contemporary scholars argued that the liberalization of the financial institutions sublimely led mortgage bankers to extensively start cloaking, circumventing the conventional ethics or wisdom of granting loans (Aluya, 2007, 2007a, 2008; Burns, 2002; Lea, 1994). Using TSHs and PESTEL, information gleaned from big data information, the Obama administration was able to detect that the actions of the mortgage bankers resulted in defaulted loans by homeowners. Defaulting on loans granted to homeowners with other econometrics resulted in the recession during this period in the United States. In the United States, the areas affected hardest with 25% or more homeowners’ foreclosures were Miami in Florida and San Diego in California (Aluya, 2007, 2007a, 2008). Homeowner’s foreclosures were due to the nonchalant attitude of financial mortgage leaders who refused to inculcate the five C’s as the perimeter guard for granting loans to applicants. With deep disrepute, the same financial institutional bankers refused to disburse, granted loans to angst individuals and the irked private investors led to the delay in the recovery of the United States economy (Maitner, 2010; Shape, 2009).

Greenspan’s successor, Ben Shalom Bernanketh (Ben), the 14th chairman of the United States treasury, continued to lower interest rates in the United States to stimulate the economy recovery. Anecdotally, Ben had referred to similar economic policy as to dropping money from a helicopter to stimulate the economy. Ben, an economist, argued against Milton Friedman’s theory that increases in the monetary supply would not stimulate the economy. Ben used the analogy that increase in the money supply was akin to dropping money from a helicopter to stimulate the economy. Ben’s theory was that infusion of money would not stimulate the economy. Ben’s actions would have been ironic or contradictory if he had not later agreed with Milton Friedman’s theory. Economists’ scholars later coined the phraseology of Helicopter Ben to mean that increasing the monetary supply in the financial sector might not necessarily stimulate the economy (Austums, 2008; Pindyck and Rubinfeld, 1989; Volberg, 2008).

In 2010 to 2017, the arcane, dynamics of using TSHs and PESTEL instantaneously in granting loans to homebuyers has yet to be completely distilled and filtered from the California corrective economic measures set for recovery. Significant to leadership in organizations and to the California homeowners was that the current economy recession was now over. California homeowners’ equity that was once robustly untouched or unspent has evaporated. Besides, California economy although still very strong, however, an unemployment rate of 7.6 now 5.6 percent in 2017 was having a torturous effect on the recovery mechanisms set in motion by the Obama administration, but now have reversed recession (Maitner, 2010; Aluya and Garraway, 2014; Aluya, 2010a).

In California, real estate investors were prevaricating and procrastinating for the cyclical economy trough to peak again, although now peaked in 2014-2017, yet unemployment remain relatively low. In terms of real estate investments, the economic recovery period was on the horizon or has reached its pre-level price before the recession in 2008. Basically, the real estate market in California was analogous to that of a cat and a mouse. The cat was waiting for the right time to pounce on the mouse. Relatively, the current recession affected all areas within California’s real estate industry. Financial institutions and mortgage bankers continued to hoard excessive cash reserves and were refusing to lend to individuals or private investors due to their previous actions that cascaded the economy into recession. Despite the recession and the slow recovery, individuals in California were purchasing homes in cash. For example, take the Seal Cliff areas in San Francisco and Pacific Palisades in Los Angeles; in these areas, the commanding price tags were from $1.5 million to $2.1 million on median homes. Uninhibited, the twisted irony or what defied logic was that the aforementioned price tags on these homes were charged on credit cards or buyers simply paid cash for these homes during the recession. Contrarians view the actions of those buying real estate at this period as averse to the recession. These transactions and other economic factotums indicated that recession was over and the United States’ economy has fully recovered in 2015 and statistically waiting for another cyclical trough to occur within the next seven years.

The unquenchable greed of mortgage lenders

Strangely, the inventors of these papyrus technologies or past anesthetic machines or smart software both living and in heaven could hardly fathom damages caused by these machines to the end users in the real estate industry. Most notably, nothing was esoteric in the application of these technologies by the sophisticated financial leaders. In this vain, these technologies were used by leaders for greediness, hubrisness, or for self-aggrandizement’s. Guillen and Suarez (2005) illuminated the dilemma of how technological huckleberry tools were imperatively and inextricably intertwined with the unquenchable greed associated with mortgage lenders. Markedly, the dilemma emanated from lenders who were technologically savvy to the contrary of the luddite buyers who were naively unaware of the craftiness of the mortgage lenders. An unsuspecting homebuyer would expect some ethical and moral ascendancy from well-established mortgage lenders in granting housing loans. To the homeowner’s amazement, ethics and morals were rated low in the books of mortgage lenders. In the parlance of the real estate industry, the syndrome of ¾ “if you Snooze, you Lose” (p.20) mentality was prevalent among mortgage lenders (Aluya, 2007).

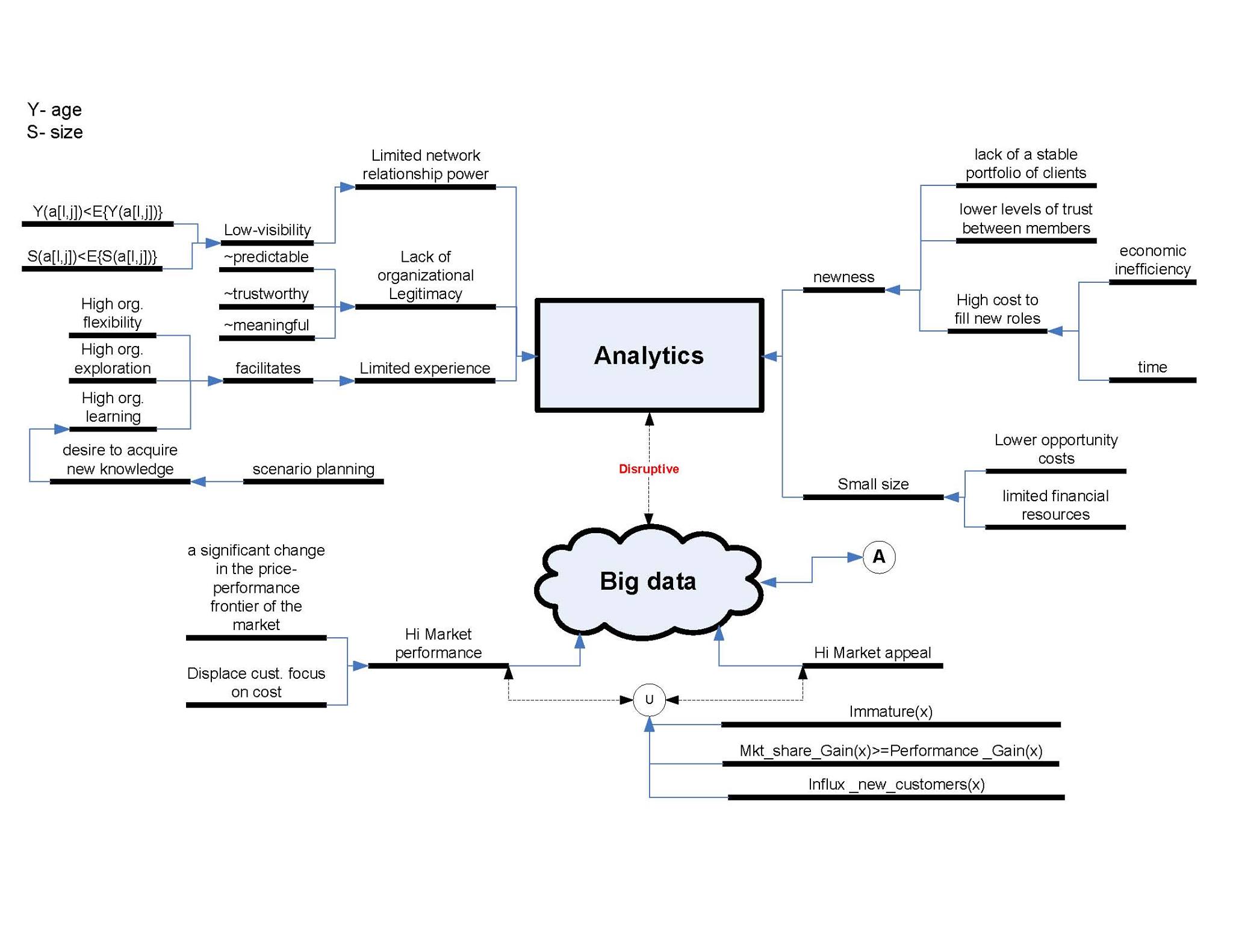

Glaring obvious facts embedded in these transactions was that the lenders do not care about whose groin they grand in the cloaked transactions. Despite claim of moral absolute, the empirical evidence gauged has contradicted their morality. For learners, the question remains what were etiological synergies that existed between the credit profile of potential buyers, the interest rates and the capacity of the buyers? The gleaned important data information from big data through the internet, extranet, and intranet drives the propellers in the engine that fosters these synergies to the detriment of the home-buyers. Before taking a cursory look at the historical trends of the internet as it embodies TSHs, it becomes imperative to discuss how TSHs were an enabler in the sub-prime loan debacle.

TSHs and PESTEL to the Sub-Prime loans debacle

In the phraseology of mortgage financial institutions, Sub-Prime loans were referred to as the B-paper, Near-prime, or simply called the Second Chance Loans (Dai and Kauffman, 2002; Fannie Mae. Org Mortgage, 2006). This ad hoc transformation and liberalization of the mortgage industry through the Greenspan regulative tenure was an encouraging elixir for mortgage lenders to become innovative and creative in granting loans to applicants with little or no credit history. Congruently, the financial risks involved in mortgage loans were higher than any other time in the United States history. And the processes or the methodologies significantly undermined the fundamental tenets of granting real estate loans. Mortgage lenders instantaneously processed loans with attached fees and extra points (percentages) charged to the unsuspecting homeowners who signed these loan documents.

During the subprime epoch, sophisticated and savvy lenders would grant loans to applicants with no verifiable work telephone numbers, no substantiated income, or any consideration given to applicant’s capacity to repay the loans granted (Klein, 2003). The five C’s used as the fundamental benchmarks in granting and approving loans were completely sunk into oblivion or into some silo. Excessive greed factors were integrated into the management system through the use of TSHs by the mortgage lenders. Unsurprisingly and expectedly, actions of these financial institutions exponentially compounded the multiplier effect that led to the United States economy into recession.

Tactically, financial management experts suggested that loan managers became only interested in meeting short-term goals with a complete disregard for the strategic positioning of the entire organization, TSHs and PESTEL were used disadvantageously as a facilitator to the detrimental of homeowners (Bowditch and Buono, 2001; Broadbent and Kitzis, 2004; Chowdhury, 2002). Approving higher interest rates to subprime loan applicants were the short-term visions of the tactical managers with no apparent strategic orientation and vision.

Most significantly was the nexus to selling these short-term loans in the secondary market and to other potential investors. For example, a small mortgage broker from Paradigm Financial (2008) could originate loans, repackaged the loans and send the loans to larger wholesale lenders such as formal Countrywide, Wochavia or Washington Mutual. Blithely obvious, these mortgage organizations were interlocked with rapacious greed of meeting their unrealistic set targets albeit clouded with short-term greed and would then sell these mortgage papers to investors in the secondary market. Bank of America, Citi bank, Merrill Lynch and other unscrupulous Wall-Street firms were synonymously entrenched with the overly inflated housing toxic papers in the secondary market.

Unequivocally, the Merrill Lynch Company for example, was in the business of buying and selling collateralized assets paper in the secondary market. Knowingly or unknowingly to these big mortgage lenders such as Bank of America, Citigroup, Merrill Lynch, and Wachovia, that the homeowners were inevitably holding the umbilical cords to these papers. The Wall Street sophisticated financial analyst’s code- named this phenomena “The Greater Fool Theory” (Aluya, 2010b)

What led to the Greater Fool Theory included the State used of securitization of tobacco litigation or potential lottery earnings used as an exotic financing of assets coded as “monetized assets” (Ibid). Banks used credit loans, composers used song royalties, and retail stores used receivables as all securitizations. Mistakes made by these sophisticated financial experts also included the creation of exotic financial introduction of reengineering of Collateralized Debt Obligation (CBO); Structured Investment Vehicles (SIV); Asset-Based Commercial Papers (ABCP). All bridged loans that went south with the clogging of the financial intermediations and contaminations of credit lines.

Modestly stated, these financial methods were bubbled up, bundled up, inflated up and later busted up. All in all, the financial system spiral and wrinkled down to economic recession in the United States. Most significantly was the debacle of the Special Purpose Entities (SPE) that was original set up to purchase the securitization debt. SPE intent and set-up by corporation was to isolate risks, thereby rapping the gain from secured debt by also assuming the risks. Three percent of the funds from outside source and ninety-seven percent contributed within the company (3/97). These risks totally went awry and besek. The infamous Enron was a company that took these explicit and implicit risks. Enron was a buyer and seller of its own risks. Surreptitiously, Iconic Enron turned into a pariah and blew into smoke that dissipated into non-existence. At this time, even the European bourses were down based on picayune decisions made by these financial experts in securitizations.

In continuation, these supposedly secured mortgage papers became toxic papers because of the inability of the homeowners to meet the agreed stated therein obligations. Selling these worthless mortgage papers in the secondary market was combustive or explosive to the United States’ dithering economy in 2008 based on the gleaned important data from the huge datasets during this time (Aluya and Garraway, 2014). Eventually, the United States economic recession retrospectively started with financial institutions holding worthless mortgage loan documents with no monetary value attached. Nine million out of fifty million homes were under the water, figuratively, the mortgages were higher than the actual market value of the homes in the United States. For example, housing in a city called Riverside, California, USA was worth three times less the value on the loan documents. Homeowners in these areas simply walked away from their homes (colloquially referred to Upside Down). Gloomily, loan defaults spiraled vertically from bottom upwards.

Loan default spiraled upwards

Loan defaults in the United States spiraled vertically from bottom upwards. Significantly, homeowners’ characteristics or capabilities to repay loans granted under an agreed obligation came under questioning. In the first instance, leading to the recession period in California, potential borrowers did not properly complete the loan applications (Aluya, 2009). In filling out the loan applications, applicants telephone numbers were missing, employment verification information were missing and this actions became the signature hallmarks of those originators or underwriters of these cloaked loans. Veritably present was the germinal theory of Thonskin Vable from 1870 to 2000 of conspicuous consumption that stated indirectly that homeowners were purchasing homes they could not afford, meaning, they were trying to keep up with Joneses next door.

Compounding the complex factors or predicaments that led to the recession were the homeowners who could not afford to make the high two to five years interest rate payments on the signed loan documents. Apparently, the homeowner’s inability to pay was complicated especially with the arcane nuances attached to the adjustable interest rates that had become due after the two to three years leading to the recession. To restate, the loan originators were interested in their commission or short-term gains regardless of whose gains were affected economically. The United States then entered the ozone layer. A tectonic financial shift from the norms, Merrill Lynch and other companies realized that the defaulted rates on these loans were abnormally detrimental to the health of their financial interest. Yes! Under some technical, legal terms and conditions attached to buying these loans from the wholesale lenders, Merrill Lynch and other major financiers could turn around, demand and request that the wholesale lenders who have besmirched themselves with these frivolous loans take back their documents. And this was a group think mentality and an irrational exuberance for wholesale lenders to buy back their loans. Good luck!!

Loan default spiraled downwards

Merrill Lynch, Bank of America and Wachovia insisted that wholesale lenders buyback their worthless mortgage papers. In all practicality and theory, buying back defaulted homeowner’s loans by the originators became impossible. Narrating further, wholesale lenders embedded with this lack of vision and financial positioning, strategically could not and would not buyback the defaulted loans (Barrera, 2001). As incredible as it might sound, overwhelming requests for wholesalers to buyback the defaulted loans led them to filing for bankruptcies. Wholesale lenders, who did not meet the legal qualified criterion to file for bankruptcies, simply closed down shops. Consequently, there was a meteoric or icarus like fall in home prices. This significant singular event cascaded the United States economy into recession in 2008. As mentioned earlier on the financial write off figures, the amount of financial losses went into billions, if not trillion of dollars on mortgage loans due to the shenanigans of the wholesale lenders in the United States. Aptly, transmuted the acute form of irrationality of the financial mortgage company’s actions of not following the fundamental tenets for granting loans to applicants was a contributing factor as to why top mortgage companies wrote off billions of dollars in uncollectable as earlier stated. Expectedly, the overall effect of the bad loans subsequently spiraled into the mortgage bankers foreclosing on homeowners due to inability of the mortgagees to meet their signed obligations. Mortgage lenders used important data gleaned from the big datasets via the internet which was part of TSHs to disseminate informative materials on the defaulted loans to the homeowners. Bringing this chapter to a relative end, the created platform on loan origination through the internet played a significant role in the sagacity of the subprime debacle. Get an electronic version of this book for continuous reading and for all the references used herein at http://www.jofdt.com/product/leadership-real-estate-and-disruptive-technology-technological-situational-happenstances-2nd-edition/