Before digressing into the current disruptive nature of the real estate and the mortgage industry, it is pertinent to know how the literature’s have explained the events from time to time. Even before the introduction of the Multiple Listing Service (MLS) to the current Internet of Things (#IoT), Industrial Internet of Things (#IIoT) and the actionable real time from the important datasets from the Big Data, indicates that leaderships within the industry now use these important data sets in making tactical and strategic decisions. These decisions could be seen in form of flip and sale of homes, foreclosures or short sales, auctions of homes in the steps of city halls or tax sales, and many more ways of selling and purchasing real estate in today’s modern society. Navigating through these land mines in the real estate industry means a person could either create abundance of wealth or starve to death. Remarkably, if a person mistakenly steps on any of the land mine, it does explodes in one of the aforementioned transactions. Therefore, understanding the organic and ground up doctrine or the significant meaning of real estate remain the crux of this article in jofdt.com. First, let’s examine the historical real estate mortgage trends in the United States of America.

Examination of the 1800s to 1950s periods

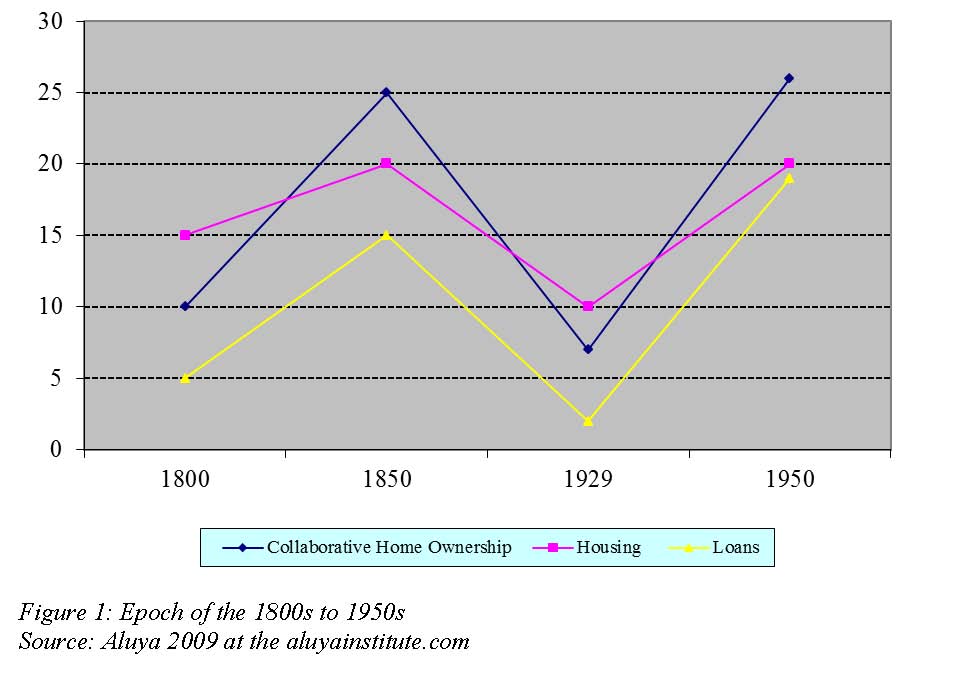

In the 1800s to the early 1930s, during the great depression, records coalesced, or gleaned indicated how the first institutional mortgage was conceptualized and implemented from proposal to fruition in the United States (Cho, 2007). All other forms of real estate transactions were known as paredoka─meaning it was an oral narratives with no apparent historical documentations during this period. According to (Cho 2007), the first institutional mortgage lending originated in 1835, and it was known as the “Terminating Building Societies” (p.171), paraphrased as TBS. Historically, in 1775, institutional mortgage lending was a novel idea extrapolated from people pooling resources together to help them own homes in England. The concept was that individuals within the pool got to purchase homes and once everyone within the pool had purchased a home, the pool was liquidated to start afresh or anew. This concept of the collaborative efforts of community members pooling resources to help one another purchase a home was popularized during the 1950s (Ibid).

Levy and Chemyak (2006) referred to the collaborative efforts of pooling resources together as the green revolution. These collaborated efforts were also prevalence in other major businesses. In the early 19th century, collaborated efforts of individuals pooling resources to purchase real estate properties were generally acceptable as the means of owning homes (Aluya, 2009). Collaborative efforts of the stakeholders must however be ingrained in the system for the possibility of home ownership to be realized. The question for learners, who were the real estate stakeholders, what were their external and internal functions within the industry? The stakeholders were regarded as the governmental agencies, financial institutions and the private sector(s). Imperatively, the functions of the stakeholders were to intrinsically and seamlessly coordinate, collaborate or implement the fundamentals of granting loans to applicants for homes or through private investments. More significantly, the stakeholders coordinated, dictated and managed other spheres of the real estate industry such as the secondary real estate market.

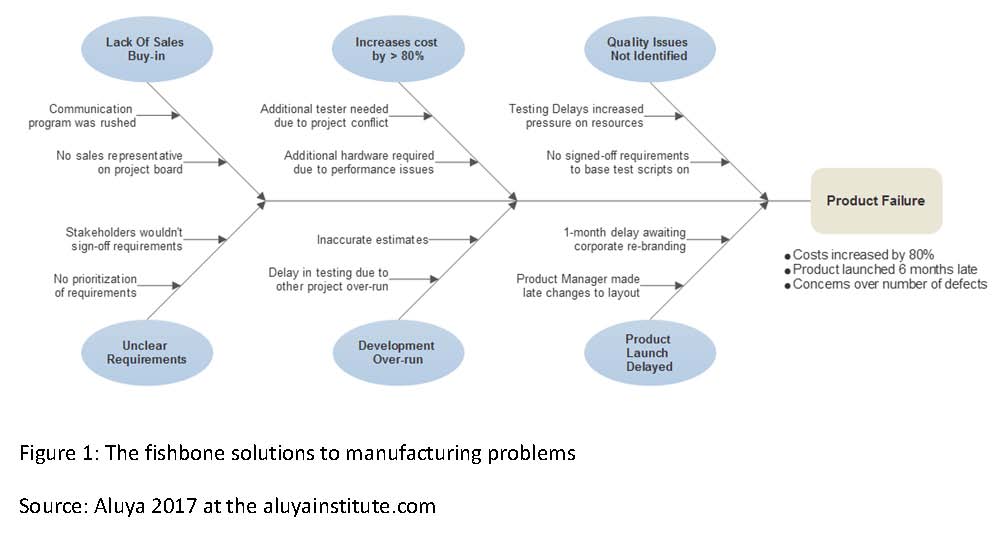

In continuation with the real estate mortgage historical trends, TBS was reengineered and transformed to be the Permanent Building Societies to Building Loans (PBSBL), then later became known as the Savings and Loans institution’s (S&L) in the United States (Cho, 2007). TBS internalized the loans granted to individuals due to the risks associated with the loans. The internalization of loans means that loans were approved and granted to applicants based on the financial institution’s internal guidelines or fiscal financial policies. According to Lea’s opus in (1994), historical records revealed that the first loan ever internally granted was to Oxford Provident. Oxford Provident however defaulted on the granted loan and a partner of Oxford Provident later paid off the loan. Experiences and lessons learned from the defaulted loans in the United States led to the separation of mortgage lenders from the institutional wholesale lenders. Mortgage lenders became private real estate brokers who coalesced, collated loans granted to individuals and sell these loans to the secondary institutional lenders. The selling of mortgage-backed bonds was used to finance areas in Southwestern and Northwestern states of the United States. In the 1930s, loan to value (LTV) was about 50% with a maximum of a 10-year requirement by the mortgagors (leaders) for mortgagees (homeowners) to pay off the balance. Comparably, in the 21st century, loans granted to swathe of burgeoning middle-income earners in Nigeria, Ghana, South Africa, and other sub-African region were characterized by amortization of the principal for 10 years with 25 to 50 percent deposit (Aluya, 2007, 2007a, 2008). Unfortunately, the middle-income earners within the aforementioned countries were enamored to have gotten these usury loans to their detriments.

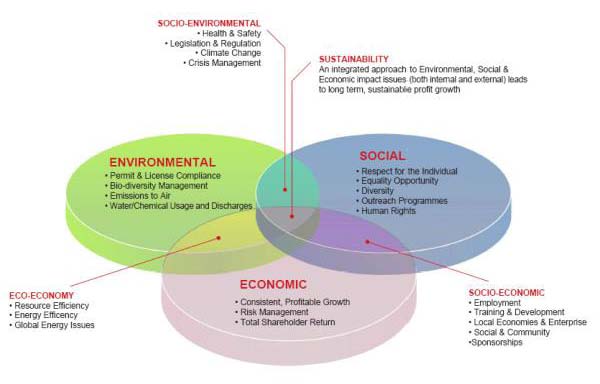

Retrospectively, the present leadership in Africa funded and granted homeowners’ loans that were reminiscent of similar methods in the United States during the 1930s. A clear indication of a correlational relationship drawn from the United States’ mortgage industries pegged in the 1930s are present in cities within the sub-Saharan African region in the 21st century. Simply put, in the sub-Saharan African cities, mortgage industries methodology of granting loans concurrently was similar to that of the United States in the 1930s. Aluya(2007) explained and explored the issues of housing shortages affecting middle-income populations in the sub-African region that were reflected in the 1930s methods of granting loans to applicants in the United States. For example, in Nigeria, Ghana, Kenya and other cities in Africa or the sub-Saharan region, interest rates on housing loans were currently pegged at 15% to 26% on a five to 10-year amortization (Aluya, 2007, 2007a, 2008). The developing nations were implementing the interlocking fundamental tenets of granting loans witnessed in the 1930s in the United States. In continuation, developing nations were yet to use TSHs expeditiously, instantaneously in generating and originating loans in an effective manner for potential loan applicants. Why? Because the Political, Environmental, Social, Technological, Economic, and legal (PESTEL) are not taken into consideration by leaderships in the industry in Africa. In 21st century, however mortgage banker’s used smart sensors analytical toolkits to glean big data in the industries and thus diminished the complexities and protocols of granting individualized loans to homeowners (Aluya and Garraway, 2014).

The unsophistication and per capital income of the population within developing nations created an uphill battle for organizations reaching their optimal capacities of using TSHs or PESTEL for comparative advantages. For example, in Nigeria, Ghana, Kenya, or Togo, people were still uncomfortable using bank cards for transactions or accessing loans, despite the fact that Smart Technologies were presently attached to the magnetic bank cards used in the Automatic Teller Machines (Aluya 2010). This method of using ATM although introduced to consumers, still remains a neophyte in some Africa areas. ATM users or potential users remained suspicious of the new technology although the global internet portal or platform remains some worth secured. For example, a Nigerian operating a diaspora account in Nigeria First Bank or Zenith Bank can easily withdrew his or her cash from a bank like Chase or Wells Fargo Bank in USA with the applicable fees attached to the withdrawals, yet with apprehensions. In the 1930s, 1940s and the 1950s, due to these similar consumer’s present behaviors in the developing nations, the United States’ mortgage institutions were institutionalized and sanitized. Tepidly, the 1960s mortgage industry approach and methodology discussed next would be different in comparable to that of the 1950s. Better yet, get a copy of the electronic version of this book here at http://www.jofdt.com/product/leadership-real-estate-and-disruptive-technology-technological-situational-happenstances-2nd-edition/